Corporate employees who choose early retirement often have many questions on what strategies they can use to save on taxes in retirement.

One strategy worth considering is converting funds in a Traditional/Rollover IRA to a Roth IRA, i.e. a Roth Conversion.

Most corporate employees have access to a 401k or similar qualified retirement savings plan from their employer. The qualified employer retirement plans offer several attractive features during the stage when one is saving for retirement: high levels of pre-tax savings contributions by the employee, often matching contributions from the employer, investment choices so that one can grow their savings, amongst other features. The 401k plan is the most common source of retirement savings for corporate employees.

However, as nice as the qualified retirement plans are for accumulating retirement savings, they can present some challenges for withdrawing funds in retirement. If one retires prior to age 55, they can still incur 10% penalties on withdrawals. If the funds are in a Traditional or Rollover IRA, this penalty applies until one reaches age 59.5. Additionally, all withdrawals from pre-tax retirement accounts are fully taxable as ordinary income when taken out.

For early retirees, high income can present interesting challenges.

If one spouse is working, or if there are other sources of income that are significant - such as pension income, employer stock plan payouts, rental income, etc. - then the additional withdrawal from a pre-tax retirement plan can add taxable income in retirement, and potentially even push one into a higher tax bracket - meaning a higher percentage of tax must be paid on ALL sources of income above the threshold.

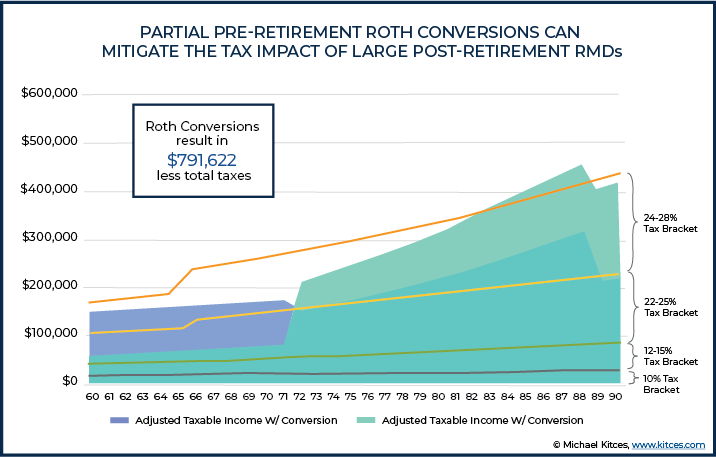

The other more significant challenge that most retirees will face on pre-tax accounts is at the point where they are subject to Required Minimum Distributions on the pre-tax assets, which is age 72 under current law. At this point, most retirees (and possibly their spouses as well) will be receiving their full Social Security benefits, and may have pension, annuity or other income. Adding an approximately 4% or greater distribution from significant balances in pre-tax accounts can potentially produce a lot of taxable income and corresponding tax liability to the retiree and their family. And if the pre-tax savings continue to grow at a decent rate or return, the liability may actually INCREASE each year as the RMD percentage increases each and every year once started.

Early retirees can take advantage of ways to control the source and taxability of their retirement distributions by planning early. One very popular technique is the use of a Roth Conversion. In this scenario, and early retiree would purposely take a taxable distribution of a portion of their pre-tax retirement savings account, pay the tax, and move the funds (convert) to a Roth IRA. The Roth IRA provides tax-free withdrawals of contributions, tax free growth in the account, and tax-free withdrawals on the earnings (assuming certain conditions, such as being over 59.5 and having owned the account for 5 years or more).

Let's look at an example of how a potential Roth conversion might look.

"Dorothy is a 60-year-old widow who recently retired with $25,000/year in Social Security widow’s benefits and an inflation-adjusting survivorship pension of $45,000/year. In addition, she has a $300,000 brokerage account, and a $1.5M IRA. When Dorothy turns 72, and her Required Minimum Distributions begin, her IRA is projected to be almost $3.4M, which will produce an RMD of almost $132,000… which, stacked on top of her inflation-adjusted pension and Social Security benefits (which will rise to almost $100,000/year at a 3% inflation rate) will drive Dorothy up into the 32% tax bracket, with more and more of her future RMDs taxed at 32% as the RMD obligation grows with age.

To manage the exposure, Dorothy decides to begin doing partial Roth conversions today of $90,000/year, all of which will be taxed in either her current 22% tax bracket or the 24% tax bracket. By repeating this process every year, Dorothy is able to substantially slow the growth of her pre-tax IRA to be ‘only’ $2.1M by age 72, which will result in an RMD of only $84,000… similar to her ongoing withdrawals during the interim years and leaving her room to avoid ever being subjected to the 32% tax bracket in the future!" (1)

If the same person where in a higher tax bracket pre-retirement or in early retirement and lower after age 72, the results become even more meaningful.

Additionally, the retiree has now given themselves two buckets from which to draw their retirement income - their pre-tax bucket (fully taxable income at withdrawal) and their Roth IRA bucket (tax free income withdrawals). For retirees whose income and spending needs vary year to year, an effective plan can now pull from the pre-tax bucket in years when income is low and from the Roth IRA when income is high, helping to keep the tax bracket and liability fairly neutral and advantaged to the retiree during retirement.

Roth conversions can also greatly benefit an early retiree's estate plan. If one expects to have more assets than they will use during their lifetime, balances converted to a Roth IRA offer tax advantages to the heirs of the retiree. Under current law, traditional IRA assets that are inherited by a non-spouse (such as children) must be withdrawn in full within a 10-year period from receipt of the assets. As pre-tax balances are fully taxable upon withdrawal, this could mean that a significant amount of assets must be taxed to their heir, which may also be at a time when they are still working and have their own significant sources of income.

By converting pre-tax balances to a Roth IRA, at the death of the retiree, the Roth assets pass to their heir's tax-free. And while the same 10 year withdrawal rules remain for Roth IRA's, since the withdrawals are tax-free to the heirs, the use of those assets does not increase the tax liability to their heir in any way.

You may want to consider exploring the benefits of a Roth IRA in the following circumstances:

1. You will be in a low tax bracket early in retirement

If you are in a reasonably low tax bracket early in retirement, it may make sense to convert Roth assets before you begin receiving Social Security or pension benefits and prior to RMD age. You may actually be able to convert amounts up to the upper range of your current tax bracket and reduce future RMD's to the point where they do not push you up to a higher tax bracket.2. You expect variable income and expenses early in retirement

If your income and expenses will vary significantly in retirement, you can explore strategies to increase your Roth conversions in lower income years and decrease them in higher income years. This helps to keep your tax bracket in manageable range in retirement and also gives you a source of tax-free withdrawals in years where expenses are high.3. You want tax flexibility for withdrawals

Even if your income and expenses are fairly stable, you may still desire to set up a plan that allows you the choice of taking taxable or tax-free withdrawals in any given year.4. You want to leave money tax free to your heirs

If helping the tax burden on your heirs is important to you, you may want to explore Roth Conversions, even if they offer less value for your personal situation. If your estate concerns are a high priority, it's worth exploring the costs and potential advantages of a Roth Conversion.5. You believe tax rates will be significantly higher in the future.

Current income tax rates in the United States are in the lower range of personal tax rates historically. With ballooning Federal debt, many people believe the Federal government will have no choice but to increase tax rates in the future to deal with the high levels of government outstanding liabilities. While it is impossible to predict with any certainty where tax rates might be in the future, if the potential for higher tax rates concerns you, a Roth Conversion may help you. You can take a known cost (the conversion amount now times the current tax rate effective on your conversion) to move assets to a tax-free account. All future growth and withdrawals from the Roth IRA are potentially tax free, so you realize a benefit for any years in which your tax bracket is higher than it was in the year in which your converted.For these and other reasons, a Roth IRA conversion can be an effective tax savings strategy for early retirees to explore. Please be aware there are additional limitations and important rules to follow regarding the nature of IRA contributions, the time the account was open and held, and the source of tax payments for the converted amount that must be considered fully before moving forward with a Roth conversion. With the help of a CERTIFIED FINANCIAL PLANNER™ and your tax professional, you can explore the impact of a Roth Conversion on your situation now and in future years to better understand how you may benefit from this unique planning opportunity.

If you'd like to see if you could benefit from a Roth conversion strategy as part of your early retirement planning, please contact us for a meeting.

Get your free guide on the Top 5 Retirement Mistakes (and How to Avoid Them) here!

About the Author:

David Edmisten, CFP®, is the Founder of Next Phase Financial Planning, LLC, a financial advisor in Prescott, AZ. Next Phase Financial Planning provides retirement, investment and tax planning that helps corporate employees retire with both financial and lifestyle security.