If you're thinking about retiring in your 50's or early 60's, you probably wonder how your investments should change as you enter retirement.

A key investment strategy that can help you have a successful retirement is the bucketing strategy. In this article, I’ll show you exactly what the bucketing strategy is, how to set it up and why it is so effective in helping people retire without worrying about the stock market.

Bucketing is a strategy that focuses on how your investments are structured, rather than on trying to choose which investments might be more successful in a short period of time.

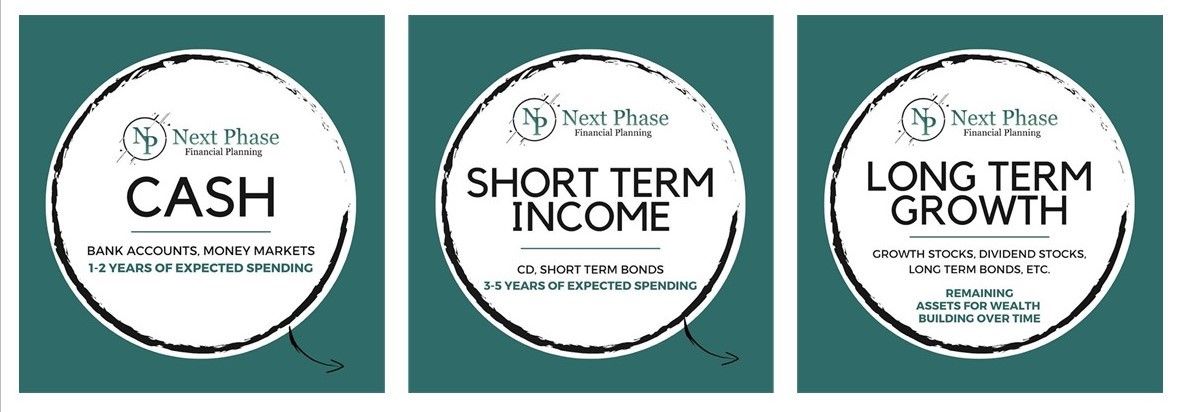

The idea with bucketing that that you separate your retirement savings and investments into 3 distinct buckets, with 3 specific purposes.

Bucket # 1 is cash.

For anyone within a few years of retiring or in retirement, it’s important to hold a bucket of cash for current spending. This bucket will hold cash that can be spent each month and some extra for emergencies. We typically recommend our clients hold 18-24 months’ worth of spending in cash at all times.

This cash bucket is so important.

Having at 1-2 years’ worth of spending in cash allows someone to enter retirement confidently and not second guess the decision to retire.

No matter what changes happen in the stock market or with interest rates, we’ve already set aside over a year’s worth of spending in cash. If you retire with the cash bucket in place, you won’t have to change your spending plans at all in the first year, even if the economy throws you some surprises.

Bucket # 2 is short term income.

In this bucket, there are no stocks. Bucket # 2 will can hold money market funds, CD’s or short-term high-quality bonds.

Typically, we’ll ladder these short-term investments so that some part of bucket # 2 is maturing each year. And nothing in this bucket will have a maturity longer than about 4 years.

We typically suggest that our clients hold about 3-5 years’ worth of spending in the short-term income bucket. This provides a couple of benefits.

First, all the investments in bucket # 2 provide interest income, which can be added back to Cash Bucket #1 to replenish what has been spent.

Second, since we have short term investments maturing every year, we always have something available to add to cash for spending, or to potentially buy more income or growth assets, depending on our client’s needs and market conditions.

Third, by holding 3-5 years’ worth of short-term income, and 1-2 years of cash in Bucket # 1, we now have a 5 year or more buffer of investments that can be used without ever having to sell a stock if the stock market is down.

This 5-year buffer is important.

According to the Wall Street Journal, taking into account all U.S. bear markets since the mid-1920s, it took an average of 3.1 years for the broad market to recover from where it stood before the bear market began on a dividend and inflation-adjusted basis. And while just over 3 years is the average, longer recoveries, such as the 2001 bear market, took almost 8 years.

By keeping a 5-year buffer of relatively stable cash and short-term income investments, you always have resources to support your spending without having to sell your stocks and lock in losses that could have been avoided during a bear market.

Bucket # 3 is long term growth assets. This is primarily stocks but could also include real estate and long-term bonds. These assets have higher growth potential and have historically appreciated in value over time.

In fact, studies show that the S&P 500 has provided positive returns 87% of the time for a 5-year holding period, 94% of the time for a 10-year holding period, and 100% of the time for holding periods of 20 years or longer.

Since growth assets like stocks have a better chance of providing a positive return the longer we hold them, we need to have buckets 1 and 2 in place to provide resources we can use so that we don’t sell stocks early or while they are down.

Using this bucket strategy also makes decisions about what to do with your portfolio easier when the markets are volatile. Simply rebalancing across the buckets can keep your portfolio in line and take away having to guess what to do or when the stock market might recover.

For example, if we’ve spent cash out of bucket # 1 and the stock market is down, we can use maturing securities and interest from bucket # 2 to replenish cash in bucket # 1.

On the other hand, if the stock market has been doing well, we can periodically sell some of the gains in bucket # 3 to replenish our cash in Bucket # 1.

In this way, decisions are easier. We only plan to sell stocks when they are higher in value, and we can keep our stocks for the opportunity to recover if stock markets are down. This provides structure and discipline to be able to buy low and sell higher, one of the fundamental rules for growing your wealth using stocks.

The bucketing strategy can be an important approach for a successful retirement.

By keeping at least a years’ worth of spending in cash, and several years of additional buffer in short term income investments, you can retire confidently and not have to worry about a stock market downturn derailing your retirement plans.

If you'd like a complimentary assessment of your retirement readiness, Schedule a Call with us.

Be sure to grab your free guide on "The Top 5 Retirement Mistakes (And How to Avoid Them) here.

About the Author:

David Edmisten, CFP®, is the Founder of Next Phase Financial Planning, LLC, a financial advisor in Prescott, AZ. Next Phase Financial Planning provides retirement, investment and tax planning that helps corporate employees retire with both financial and lifestyle security.